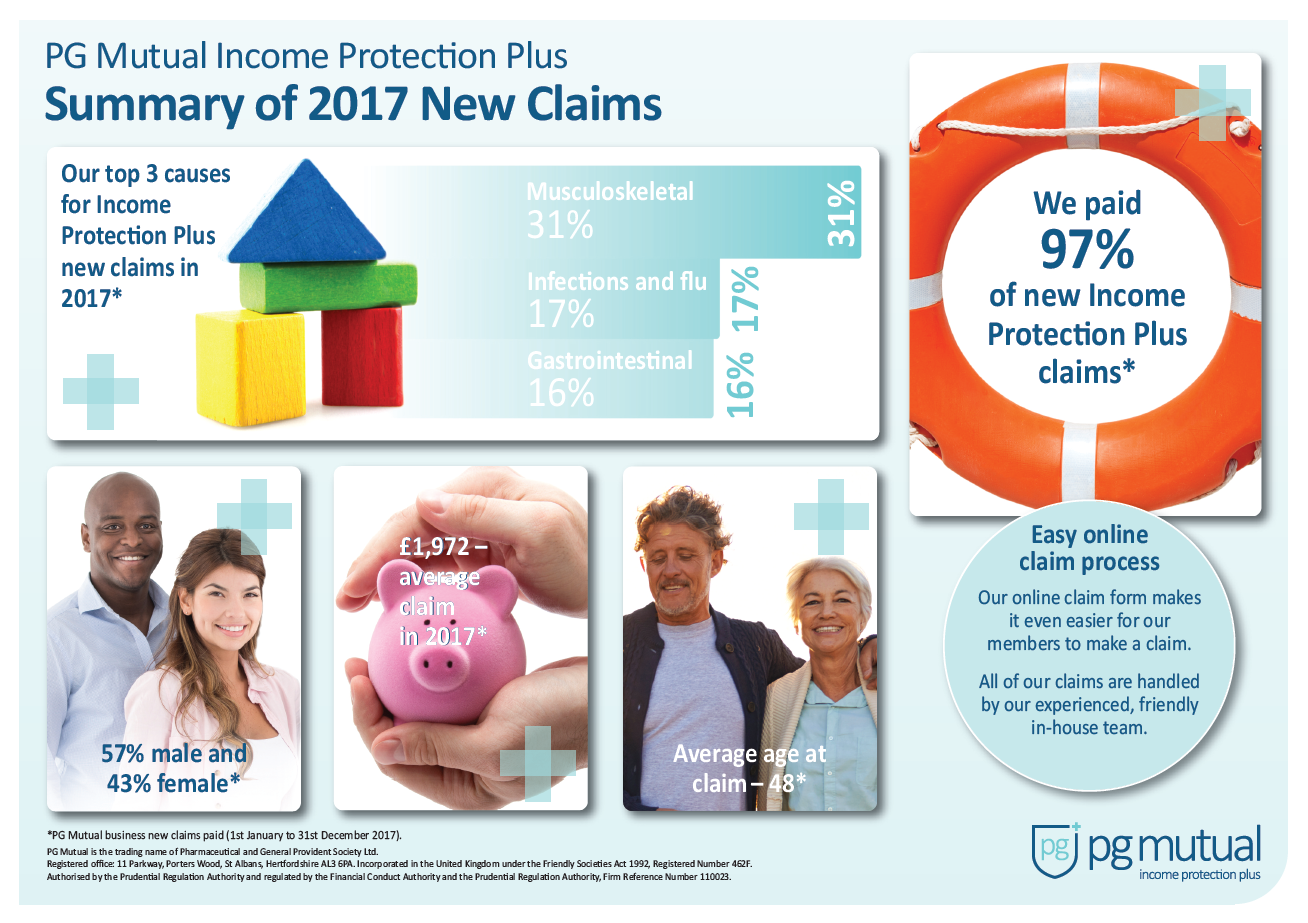

PG Mutual Paid 97% of Eligible Claims in 2017

Our final claims figures for 2017 are in and we are thrilled with the results. In 2017, 97% of new Income Protection Plus claims were eligible for payment. That’s very comprehensive cover! Our top 3 causes of Income Protection Plus claims in 2017 were: Musculoskeletal at 31% Infections and flu at 17% Gastrointestinal at 16% Our average pay out for a claim in 2017 was £1,972.00 and the average age of those who claimed was 48. Hannah Crossley, Membership Services Manager at […]